Understanding Interchange Plus Pricing in Credit Card Processing: A Comprehensive Guide

Credit card processing is a vital part of modern commerce, offering convenience for consumers and businesses alike. A key component in this process is understanding the pricing structures, particularly the interchange plus model. This article will demystify the various elements involved, such as gateways, processors, banks, and card networks, and explore how features like network tokens, level 2 and 3 data, and least cost routing can help in reducing processing costs. For a guide including an example merchant statement please see this deck: Interchange Plus Pricing.pdf

What is Interchange Plus Pricing?

Interchange plus pricing is a transparent pricing model used in credit and debit card processing. It separates the two main costs involved in processing a card payment: the interchange fee set by the card networks (like Visa and Mastercard) and the markup charged by the processor. This model is favored for its clarity, allowing merchants to see exactly what they're paying for. Let's explore each component:

1. Interchange Fee: The interchange fee is a fee paid to the card-issuing bank and is set by the credit card networks (Visa, MasterCard, Discover, American Express). This fee varies depending on several factors, including the type of card used (e.g., debit, credit, business, or rewards card), the transaction's nature (e.g., online, in-person), and the merchant's industry. Interchange fees are non-negotiable and the same for all processors. They represent the base cost of processing a transaction. Although these fees cannot be negotiated various strategies can be used to lower these fees and they are described below.

Interchange fees are made public by most card networks and can be found in the links below. Additionally, some acquiring banks publish much more detailed explanations of how those fees work, but restrict sharing or reposting those fee explanations.

Visa Fee Schedule

Mastercard Fee Schedule

AMEX Fee Schedule

2. Markup: The markup is the additional cost added by the payment processor to cover their services, which includes processing the transaction, customer service, and providing payment technology and security. Unlike interchange fees, the markup is negotiable and varies from one processor to another. It's where payment processors make their profit.

Identifying mark-up can be complicated for many businesses when looking at their merchant statements because there is no standardized format or line item names in the payment processing industry. This is where leveraging consultants like those at Reform Payments Consultants LLC can aid in understanding, optimizing, and negotiating fees.

How Interchange Plus Pricing Works

In the interchange plus pricing model, the total cost of a transaction is the sum of the interchange fee, the markup, and any additional network fees charged by the card networks. The pricing is often quoted as a percentage plus a fixed fee per transaction. For example, if a processor offers you a rate of 0.30% + $0.10 per transaction, this means you'll pay the interchange fee, a markup of 0.30% of the transaction value, and a $0.10 fixed fee for each transaction processed.

Key Elements of Credit Card Processing

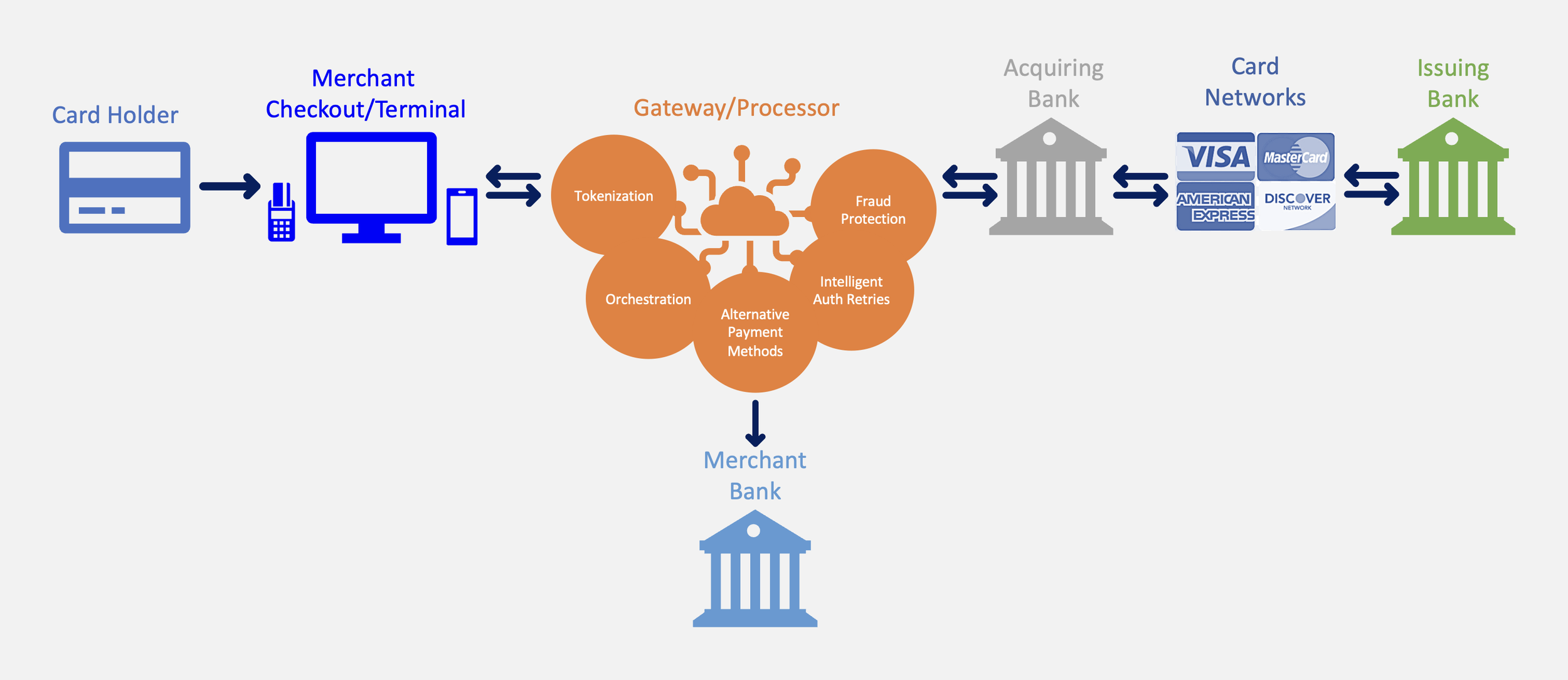

1. Gateway: This is the technology that facilitates the transmission of transaction data. It's like a bridge connecting the merchant's system to the processor.

2. Processor: The processor is the entity that handles the technical aspect of processing the payment – they move the transaction data between the merchant, the acquiring bank, and the card networks.

3. Acquiring Bank: Also known as the merchant's bank, this is the financial institution that maintains the merchant's account. It receives the funds from card transactions.

4. Card Network: These are entities like Visa, Mastercard, and American Express that oversee and regulate the use of their respective cards and set interchange fees.

5. Issuing Bank: This is the bank that issued the credit card to the consumer. They are responsible for paying the acquiring bank after a transaction.

Advanced Features in Credit Card Processing

1. Network Tokens: These are unique identifiers used to secure transactions. They replace sensitive card details with a token that is provisioned by the card network, thus reducing the risk of fraud and potentially lowering interchange fees.

2. Level 2 and Level 3 Data Processing: This involves transmitting more detailed transaction data. Providing additional data like customer codes or tax amount can qualify transactions for lower interchange rates, especially beneficial for B2B transactions.

3. Least Cost Routing: This feature is crucial for debit card transactions. It allows the transaction to be routed through the network that costs the least, thus reducing processing fees.

How These Features Affect Costs

Network Tokens: By enhancing security, network tokens can qualify transactions for lower interchange rates, as they are deemed less risky. This savings is up to 10bps for Visa cards at the time this article was written and other card networks are expected to create similar strategies.

Level 2 and 3 Data: The more data provided, the more assurance there is about the transaction's legitimacy, which can lead to lower fees. The savings for each merchant varies depending on what percentage of their card mix is purchasing and corporate cards. For eligible card types savings is typically between 60-85bps.

Least Cost Routing: For debit transactions, choosing the network with the lowest fee can result in significant savings.

Interchange plus pricing in credit card processing offers transparency and can lead to cost savings, especially when combined with features like network tokens, enhanced data processing, and least cost routing. Understanding these elements is crucial for businesses looking to optimize their payment processing solutions. By leveraging these technologies and data, merchants can ensure more secure, efficient, and cost-effective transactions.